This document shows how to use the tool “Remittances Banking Collections”. Its function is to create banking remittances: receipt groups to send to the bank and make the charge. Effects available to add to a banking remittance are those negotiable per bank (Option in “Payment Condition”) and those not included in a remittance.

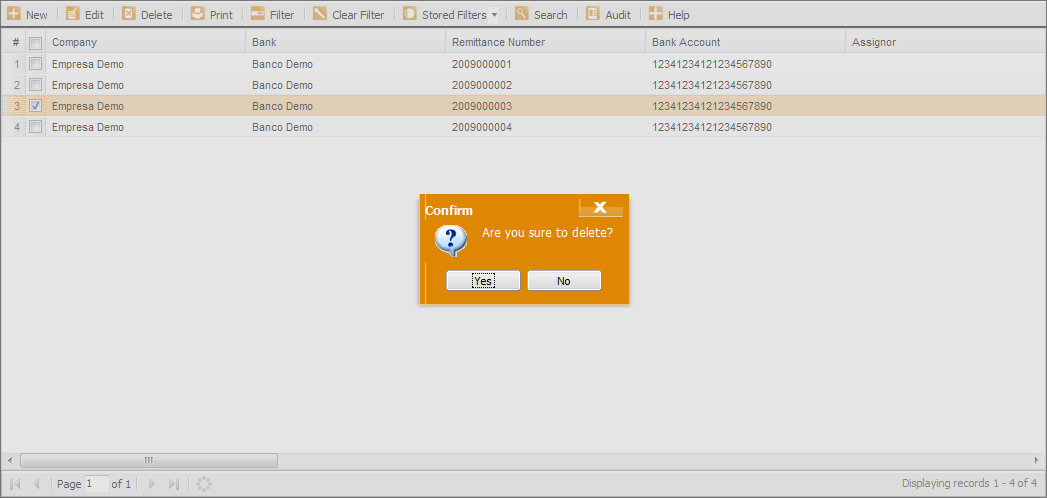

View of the main page:

Information appears distributed in columns arranged horizontally. However, the program allows us to make a distribution through the following options:

-

Columns: in the box that introduces each column there is a small tab on the right. Here appears the option “Column”, which allows us to select or disable the fields that are displayed on the main screen.

-

Sort: option of sorting the information in the column in an ascending or descending way.

-

Filters: (see Filters).

On the other hand, the size of the columns can be changed using the cursor that appears between them.

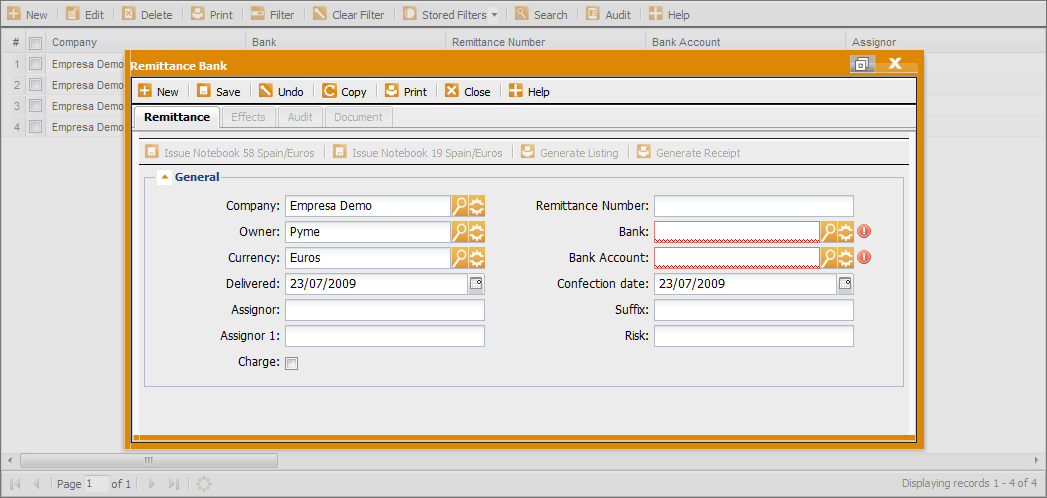

Toolbar, option “New”:

-

New:

-

Issue Notebook 58 Spain / Euros: saved the data in the banking remittance, the user has the option to generate a “Notebook 58” for the management of the recoveries. The Bank advances the payments from the customers.<

-

Issue Notebook 19 Spain / Euros: receipts in sight. Arrears by direct debit. Remittances send to the bank in order to recover the amounts from the customers.

-

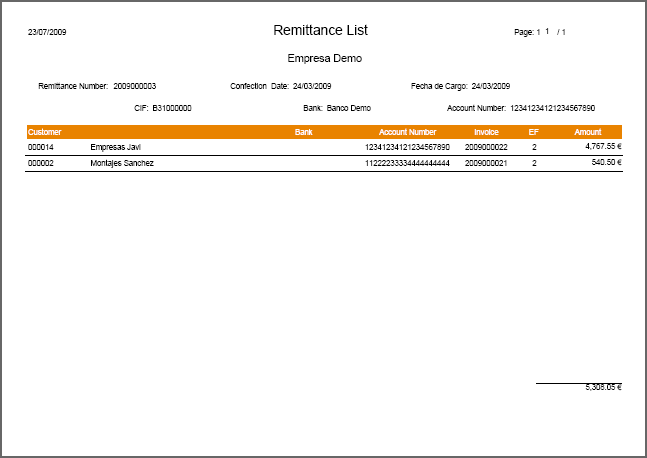

Generate Listing: option to generate a report with the effects of the remittance.

-

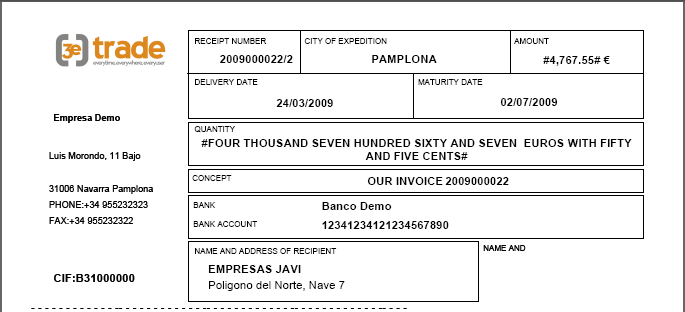

Generate Receipt: option to generate receipts of the remittance.

Below the toolbar “New” there are four buttons that allow actions on the remittance:

In order to have this options active, a record must be created first.

-

Remittance:

-

Company: company which does the remittance.

-

Remittance Number: code generated automatically when saving a new remittance.

-

Owner: option to add an owner.

-

Bank: bank the company works with. Is the one which receives the remittance.

-

Currency: currency used in the remittance.

-

Bank Account: account in the bank selected. It will receive the payments of the remittance.

-

Delivered: date when we want the bank to charge the receipts.

-

Confection Date: date of the creation of the remittance.

-

Assignor: data provided by the bank to generate a “Notebook 58”.

-

Assignor 1: data provided by the bank to generate a “Notebook 58”.

-

Suffix: data provided by the bank to generate a “Notebook 58”.

-

Risk: code provided by the bank to generate a “Notebook 58”.

-

Charge: field to indicate whether the remittance has been charged to the bank or not.

Toolbar “New”, besides “Remittance Bank”, provides the following options, which will be opened as the user saves the changes:

-

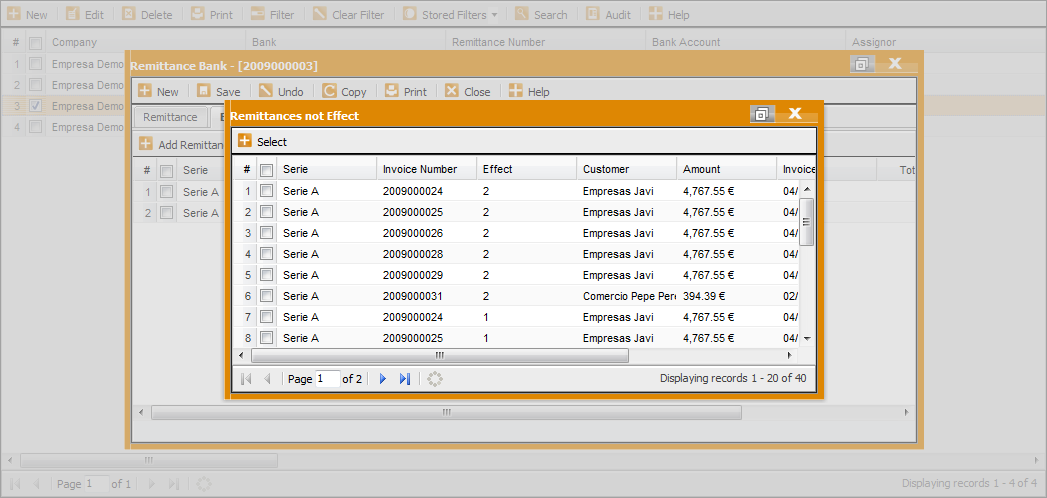

Effects: tab that shows all the records of the effects within the remittance bank. The effects available to add are those negotiable per bank (option in “Payment Condition”) and those not included in a remittance. The company has the right to recover the effects when the maturity date comes.

-

Add Remittance no effect: allows adding effects not remitted. Click this button and select the effects. It will only show those available to add.

-

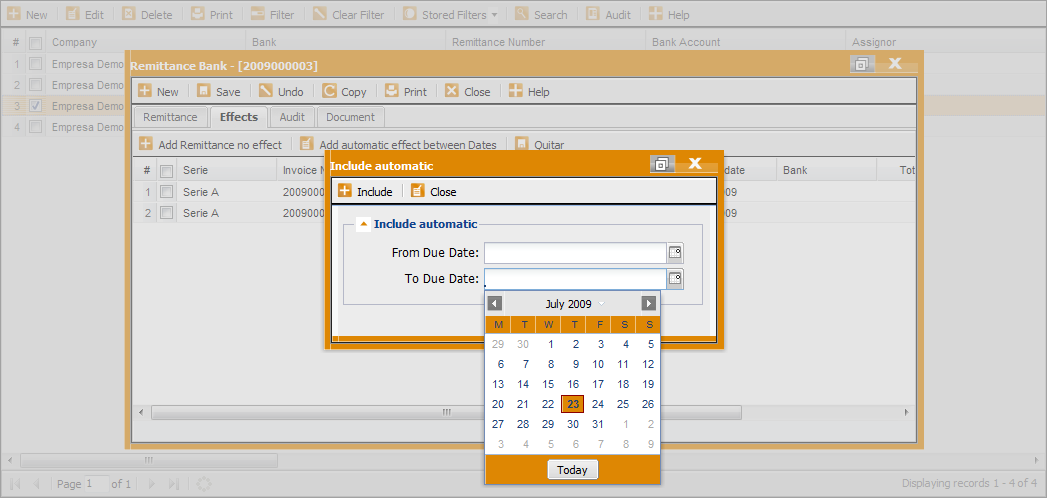

Add automatic effect between dates: allows adding effects to the remittance according to their date. Click this button and select the dates in which we want to search for effects.

-

Quit: option to delete an effect from the list. Select a record and click “Quit”.

Below the toolbar of this tab, we find three buttons:

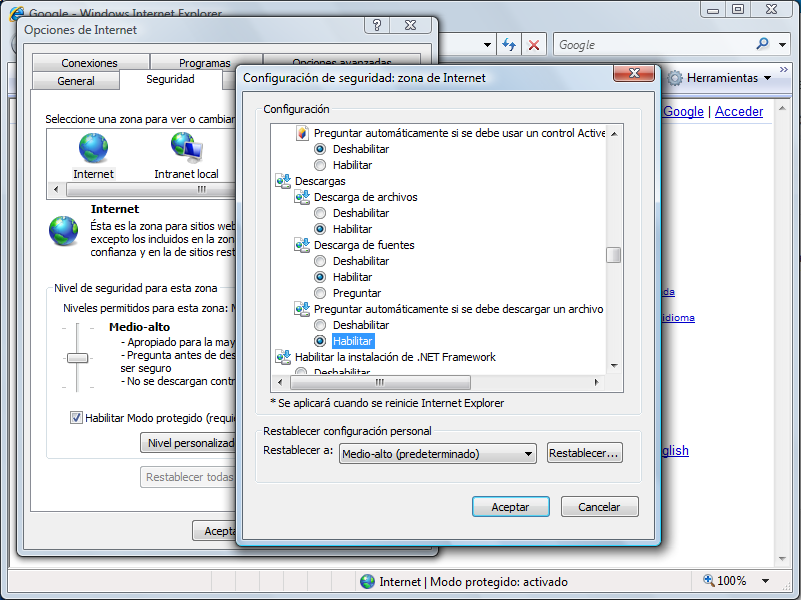

How to download a remittance file from Internet Explorer:

-

In the “Tool” menu, press “Internet Options”.

-

Select the tab “Security” and “Personalized Level”.

-

A window is opened with the option “Ask automatically if a file should be downloaded”. Press “Authorized”.

-

Press “Accept” and “Apply” to active the change.